Many business owners suffered an economic hit in 2020 when so much of the world’s economy ground to a slow the spread of the Covid pandemic. With incomes and revenues dropping, choosing an affordable mortgage has never been such a tough challenge for business owners.

This is a sponsored post. Please refer to my disclosure for more information.

What is your income going to look like 12 or 24 months from now? Should you look at mortgage affordability based on your 2020 income, even though it was such an unusual year? Should you consider your pre-2020 income instead and expect the economy to return to normal once the pandemic is over? Or do you need to bring other factors into consideration?

If those are the types of questions going through your mind, this article will give you some clear guidance about what you need to consider when applying for a mortgage in 2021.

2020 – An Unprecedented Year For Business

According to Businesswire, over 43% of small businesses reported a severe impact on their business in 2020 as a result of the pandemic. Over half had a significant drop in sales over the year.

The worst affected industries included accommodation, food, arts, entertainment, education, and transport. If your small business has suffered during 2020, then you aren’t alone.

But what does this mean for the future when it comes to getting a mortgage?

The 2021 Economic Outlook and Mortgage Market

When looking at the economic outlook for 2021, most experts use the term cautiously optimistic.

What this means for anyone looking at mortgages is that although things may be on the up, there is still a great deal of nervousness in the market.

However, there are other factors at play. According to the Financial Times, increased competition in the lending market could actually push rates down in 2021. This is good news for anyone looking for a mortgage this year.

Applying For a Mortgage in 2021

With so much uncertainty in the economy, applying for a mortgage in 2021 is not as straightforward as it has been in previous years.

To get the best mortgage, you need to have a very clear understanding of your own financial circumstances, and understand how to shop around for the most competitive deal.

Here are some key steps to take.

Step 1: Get Your Finances In Good Order

Review your current financial situation, especially your debt exposure. If your income has dropped in 2020, are there any cutbacks you can make that will reduce your outgoings? Can you pay off some existing debt to reduce your overall debt levels?

This type of advanced budgeting to reduce spend will favor you when it comes to making a mortgage application. It’s also going to help when it comes to doing your own calculations about the type of mortgage you can afford right now.

Step 2: Check your credit rating

Having an excellent credit rating will help you get a competitive mortgage. Use credit score services such as Experian to see how your current credit status looks. If there are red and amber areas, take time to focus on improving those finances before you apply for a mortgage.

The better your credit score, the more likely you are to be approved for a mortgage with a good competitive rate.

Step 3: Be Honest About Your Affordability

There is little any of us can do to control the wider economic climate we are in right now. But we can weather the storm a bit better with some sensible financial planning.

Calculating a future budget can help you decide on how high you can go with your mortgage payments. Use this opportunity to add a financial cushion to your finances to cover any future problems that we can’t yet predict.

Researching The Best Affordable Mortgage

Once you have a complete picture of your finances, it’s worth taking the time to do your research and find the best affordable mortgage currently on the market.

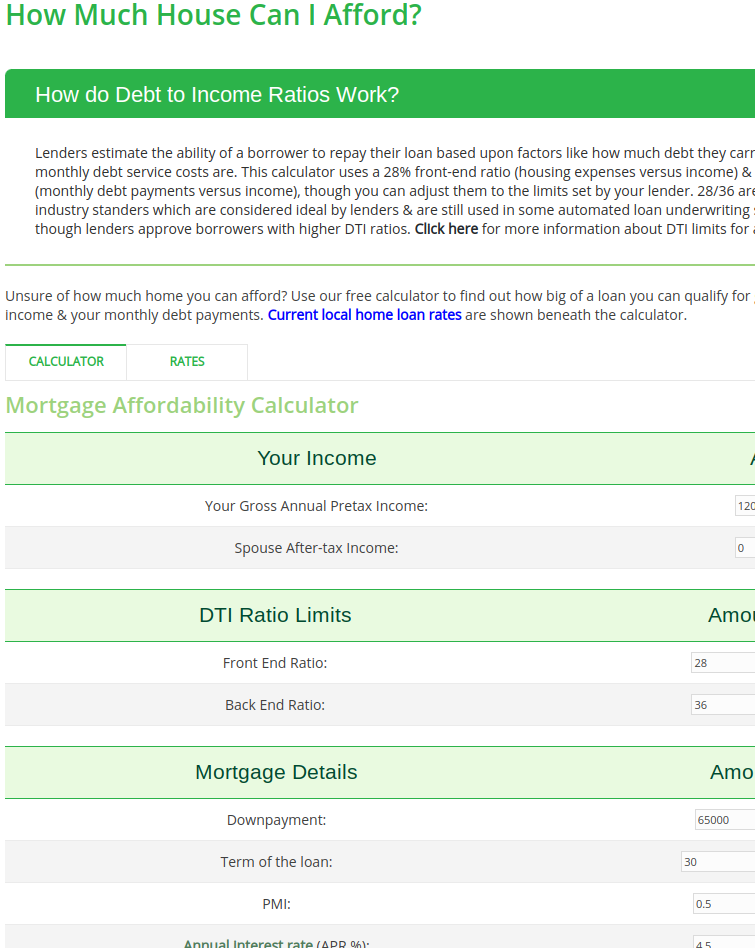

The fastest and most effective approach is to use a good mortgage calculator such as this comprehensive online mortgage calculator from MortgageCalculators.info. The financial preparations you’ve made up until this point are going to be your starting point for finding the right type of mortgage.

This mortgage calculator is going to allow you to look at the numbers, get example figures on the types of loans you could apply for, and give you a true picture of what is affordable for you within your financial circumstances.

Types Of Mortgages Available

Before completing the mortgage calculator, take time to research the types of mortgages available to get a clear understanding of what is the best fit for you. There are 6 main mortgage types:

- Conventional

- Conforming

- Non-conforming

- FHA insured

- USVA insured

- USDA insured

The time spent researching your options is what will allow you to get the best mortgage offers on the market.

Fine-Tuning Your Finances

You can also use this opportunity to tweak the results (MortgageCalculators.info has some useful tips on how to tweak the numbers). If you want a safer financial cushion to help protect you against future economic uncertainty, which is essential for small business owners, you can look at a reduced loan amount that won’t stretch your finances to the limit.

Running these calculations yourself means you can also avoid the pressure of accepting the recommendations of a financial consultant who may have a different attitude to risk that you have with your own personal finances.

Comparing The Offers

Once you have run the mortgage calculator and are happy with your loan options, you can use that information to compare a full list of the mortgage rates and providers that meet your criteria.

Here are some important numbers you need to look at when making the comparison and finding your perfect mortgage:

- Whilst the lowest rate is the obvious comparison, make sure to look at the total interest paid over the full life of the mortgage for a clearer picture of the cost

- Read reviews on the mortgage lender. What is their customer service like? How long does it take to get approval? Is the application process easy?

- Don’t forget to look at all the mortgage fees too so you get a true idea of the mortgage costs.

Your Next Steps

If you’re determined to make 2021 the year you discover your dream home, get smart with your finances today. A clear picture of where you are, where you are likely to be, and how well insulated you are from economic disruption is your first task. And when it comes to finding the perfect affordable mortgage: research, research, research!