With so much uncertainty in 2020, and many economies taking a sharp GDP plummet as Covid tightens its grip, the sheer thought of starting a business might seem to some like a risk too far. But to heavily paraphrase Warren Buffett, you’ve to grab opportunities when others are fearful. And with so many jobs and industries holding such an uncertain future, the potential of running your own business and taking on that risk yourself is an attractive prospect for many.

This is a contributed post. Please refer to my disclosure for more information.

But when it comes to finances, what can you do to protect your money and security when launching a business? Here are eight key recommendations you should take with your finances before launching your new startup.

Keep startup costs low

So many aspects of launching and marketing a new business are cheaper than they have ever been. You can create a website in a day for less than $10, and with no marketing skills, hosting is cheap, and platforms like Facebook and Google allow you to advertise with the tiniest starting budget. On top of that, you can tap into a worldwide network of experts in many different areas, from accounting to tech support, so take advantage of this.

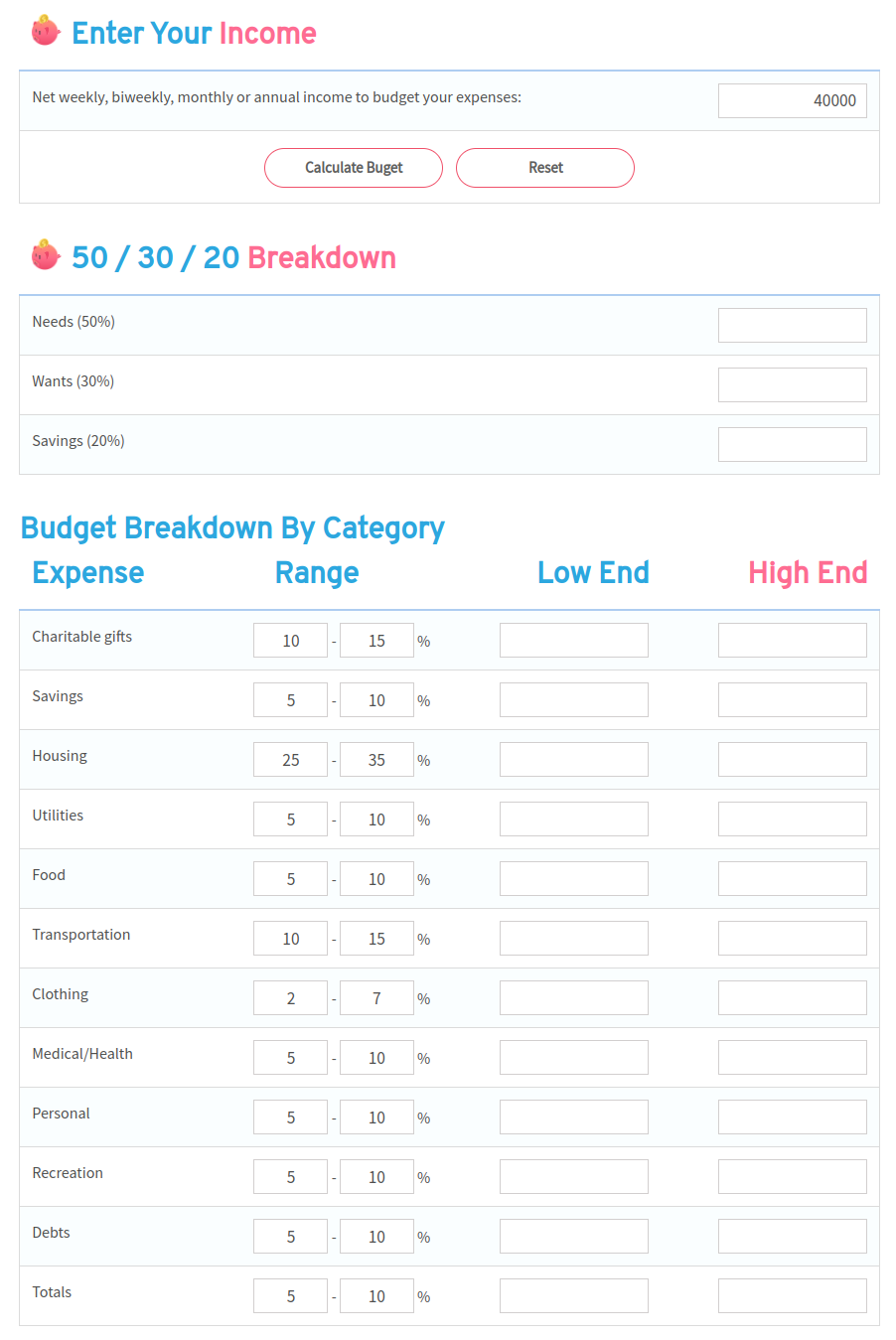

Audit your outgoings

When you create your business plan, take time to consider your own personal finances and the outgoings you’ll need to cover – at an absolute minimum, over the next 6-12 months. This is a great way to ensure you always have a financial cushion should your business run into problems. Use a budget calculator to provide a thorough breakdown of your spend and look at ways you can cut back on luxuries over the next 6-12 months so that you can keep up with all your important bills, even if you have a bad month in your business.

Shop around for the best deals

Make sure that when you have big expenses in your business that you are getting the best deal possible. Shop around, using comparison websites for things like business insurance, and look at alternative products before you commit to a big expenditure for your business such as web hosting (where there are some great introductory deals to be found).

Look at what big spends you can put on hold

If your life dream is to start a business, let that guide your path for the next 12 months. Avoid other big life changes that come with disruption and expense, like vacations, moving house or getting married. By giving your startup 100% of your focus and your money for the next 12 months, you’ll put yourself in a much better position to pursue those other big life dreams.

Carefully (and honestly) forecast your earnings

One of the most common mistakes new businesses owners make is to overestimate their sales and earnings in their first year of business. In fact, this is one of the big causes of so many businesses going under. Avoid this by taking time to work out a cautious estimate as well as an optimistic estimate of what your sales projections are going to be. Think about bumps in the road that might slow you down when it comes to product launches, such as technical glitches, legal hold ups, or staff shortages. Reporting your earnings can be stressful if you’ve never done it before, and you may consider outsourcing to an sme accounting firm to help you do this correctly and avoid overestimating your sales and earnings.

Budget your ad spend carefully

A big error many startups make is to run an expensive online ad campaign to get their business up and running. Whilst ad spend is potentially very profitable (I have written a useful case study here) first-time ad campaigns to new businesses seldom are, because of the number of unknowns. Instead, set a small ad budget and test the waters. See what types of ads and products get a good reaction (modern ad platforms like Facebook and Google make this easier than ever) and when you start seeing a good ad performance, that’s the time to increase your ad spend and start seeing improved returns.

Plan for more uncertainty

This would have been a good tip to write at the end of 2019, given what has happened this year and the fact so very few people had the foresight to see that something like this could happen. When it comes to your finances, and especially your business finances, always leave as much room as you can for something unpredictable to happen that could throw you off course.

Now more than ever, we don’t know what the future holds, whether that’s pandemics, political unrest, climate change or worldwide economic recession. We can’t put our lives on our dreams on hold because something bad might happen; but if we embrace the fact that the future will contain some surprises, we can do our bit now to make ourselves as ready as we can be for it.

Have a backup plan

If you have a skill that is in demand for freelance work, consider having that in place as a backup. Create a profile on a few freelance sites and do a little bit of work to get a couple of reviews, and if the worse comes to the worse, you know you have a backup plan ready-and-waiting (and even in difficult economic times, there are always some freelance jobs in demand). It’s always sensible to have a few ways of making sure your bills are always paid when starting a business so that even in the most challenging times, you can pay for that roof over your head and the winter heating bills.

Next steps

Take some time this weekend to start getting your business and personal budgets together (there are some useful budgeting tools here). Be honest rather than optimistic, and recognise the uncertainty we all face right now. You can succeed with a new start-up in this economy, and there are a lot of opportunities right now (eCommerce, in particular, is continuing its upward path as more people shop from home), but don’t let your dreams be shattered by a fear of the next household bill dropping through the letterbox.